sales tax calculator buffalo ny

400 New York State Sales Tax 088 Maximum Local Sales Tax 488 Maximum Possible Sales Tax 848 Average Local State Sales Tax. Keep abreast of all changes in the New York State Real Property Tax Law RPTL affecting the City of Buffalo.

Which States Require Sales Tax On Clothing Taxjar

RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car.

. For information on the Oneida Nation Settlement Agreement see Oneida Nation Settlement Agreement. The minimum combined 2022 sales tax rate for Buffalo New York is 875. The Sales Tax Calculator can compute any one of the following given inputs for the remaining two.

Sales tax see sales tax information title certificate fee of 5000. W-9 tax exemptions sales tax 1099s. The New York sales tax rate is currently 4.

Price at the Pump per gallon Gasoline Price Federal Excise Tax. NYS Petroleum Testing Fee. There is no applicable city tax or special tax.

New York on the other hand only raises about 20 percent of its revenues from the. The Erie County Sales Tax is collected by the merchant on all qualifying sales made within Erie County. The Erie County New York sales tax is 875 consisting of 400 New York state sales tax and 475 Erie County local sales taxesThe local sales tax consists of a 475 county sales tax.

Buffalo is in the following zip codes. Buffalo NY 14220 South Park area Estimated 456K 578K a year. Groceries are exempt from the Erie County and New York state sales taxes.

Living in New York City adds more of a strain on your paycheck than living in the rest of the state as the Big Apple imposes its own local income tax on top of the state. 0125 lower than the maximum sales tax in NY. Buffalo NY Sales Tax Rate The current total local sales tax rate in Buffalo NY is 8750.

Total Taxes NYS Sales Tax. Sales taxes for a city or county in New York can be as high as 475 meaning you could potentially pay a total of 875 sales tax for a vehicle in. Net Price is the tag price or list price before any sales taxes are applied.

The table below shows the total state and local sales tax rates for all New York counties. If this is the original registration first time you register your vehicle you must pay the. This means that depending on where you are actual rates may be significantly higher than other parts of the country.

YP - The Real Yellow Pages SM - helps you find the right local businesses to meet your specific needs. Total Price is the final amount paid including sales tax. For State Use and Local Taxes use State and Local Sales Tax Calculator.

You can print a 875 sales tax table here. This is the total of state county and city sales tax rates. Sales Tax Breakdown Buffalo Details Buffalo NY is in Erie County.

The 875 sales tax rate in Buffalo consists of 4 New York state sales tax and 475 Erie County sales tax. South Lake Tahoe CA. Sales tax applies to retail sales of certain tangible personal property and services.

Preparation and distribution of all property tax and sewer rent bills as well as local assessment bills including sidewalks demolitions etc and the maintenance of all associated records. Buffalo in Missouri has a tax rate of 773 for 2021 this includes the Missouri Sales Tax Rate of 423 and Local Sales Tax Rates in Buffalo totaling 35. If you leased the vehicle see register a leased vehicle.

Use tax applies if you buy tangible personal property and services outside the state and use it within New York State. At 4 New Yorks sales tax rate is one of the highest in the country. Enter zip codeof the sale location or the sales tax ratein percent Sales Tax Calculate By Tax Rateor calculate by zip code ZIP Code Calculate By ZIP Codeor manually enter sales tax New York QuickFacts.

Bronx Kings Brooklyn New York. An additional sales tax rate of 0375 applies to taxable sales made within the Metropolitan Commuter Transportation District MCTD. RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car.

Overview of New York Taxes. Did South Dakota v. For tax rates in other cities see New York sales taxes by city and county.

One of a suite of free online calculators provided by the team at iCalculator. 00005 NYS Excise Tax. Sales tax rates and identifying the.

Search results are sorted by a combination of factors to give you a set of choices in response to your search criteria. These factors are similar to those you might use to determine which business to select from a local Yellow Pages directory. Real property tax on median home.

Knowledge in required documents ie. New York has a 4 statewide sales tax rate but also has 640 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 4254 on top of the state tax. Preparation of all delinquent tax.

The County sales tax rate is 475. Sales Tax Calculator in Buffalo NY. Sales Tax Amount Net Price x Sales Tax Percentage 100 Total Price Net Price Sales Tax Amount.

And several of these states raise nearly 60 percent of their tax revenue from the sales tax. Sales Tax State Local Sales Tax on Food. If the vehicle was a gift or was purchased from a family member use the Statement of Transaction Sales Tax Form pdf at NY State Department of Tax and Finance DTF-802 to receive a sales tax exemption.

New York state has a progressive income tax system with rates ranging from 4 to 109 depending on taxpayers income level and filing status. However all counties collect additional surcharges on top of that 4 rate. MCTD 1 fee for the following 12 counties only.

Erie County Comptrollers Office Edward A. The December 2020 total local sales tax rate was also 8750. 14201 14202 14203.

This means that depending on your location within New York the total tax you pay can be significantly higher than the 4 state sales tax. The Buffalo sales tax rate is 0. Real property tax on median home.

The DMV calculates and collects the sales tax and issues a sales tax receipt. The Associate Accounts Payable Analyst will be an analytical accounts payable. See how we can help improve your knowledge of Math Physics Tax Engineering and more.

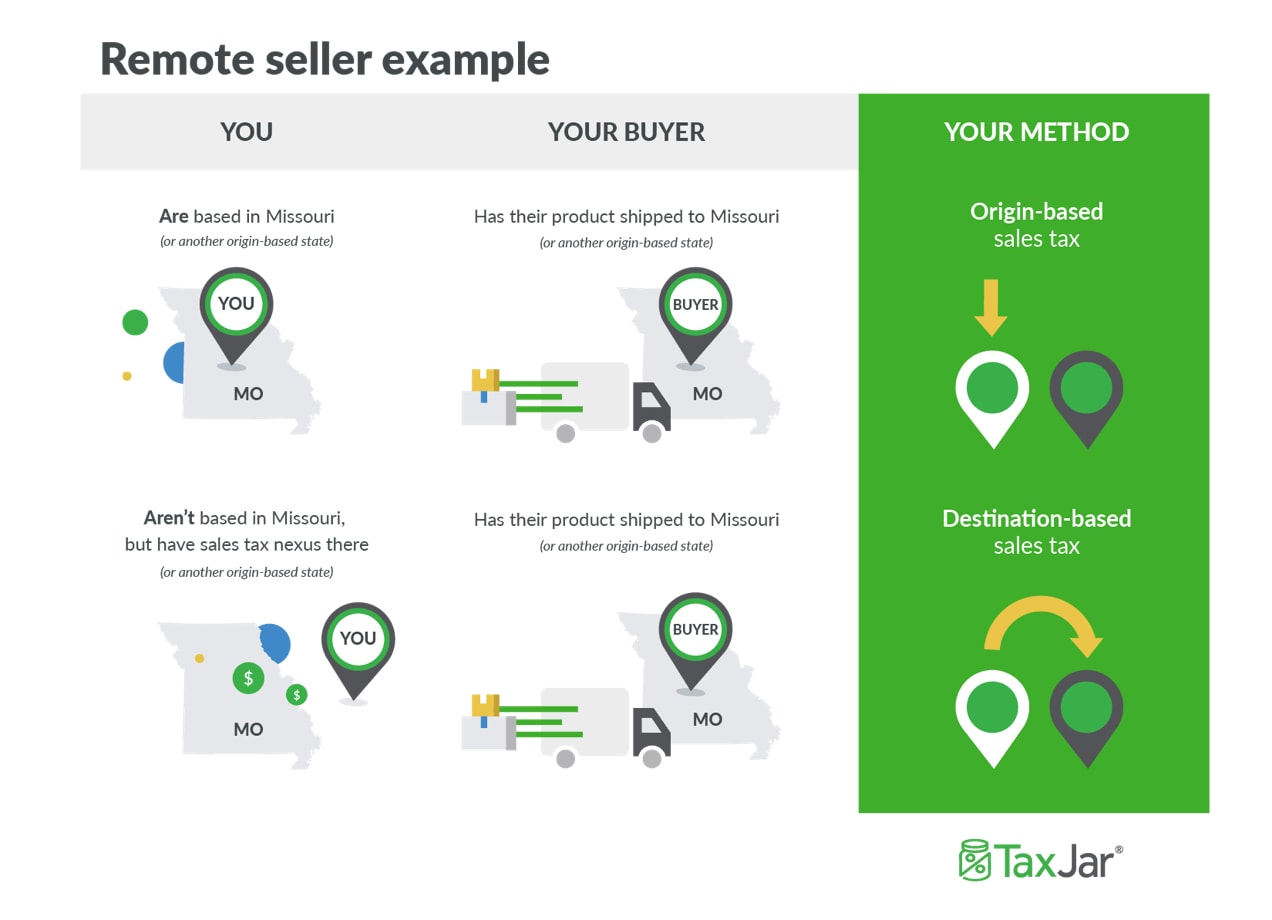

Sales tax rates The combined sales and use tax rate equals the state rate currently 4 plus any local tax rate imposed by a city county or school district. Active 5 days ago. Sales Tax State Local Sales Tax on Food.

2022 Final Assessment Roll. Before-tax price sale tax rate and final or after-tax price. How to estimate registration fees and taxes.

Rath County Office Building 95 Franklin Street Room 1100 Buffalo New York 14202.

How To Charge Your Customers The Correct Sales Tax Rates

How To Charge Your Customers The Correct Sales Tax Rates

Online Sales Tax Compliance Ecommerce Guide For 2022

New York Vehicle Sales Tax Fees Calculator

The Seller S Guide To Ecommerce Sales Tax Taxjar Developers

How To Charge Your Customers The Correct Sales Tax Rates

South Dakota Taxes Sd State Income Tax Calculator Community Tax

How To Calculate New York Sales Tax 14 Steps With Pictures

How To Charge Your Customers The Correct Sales Tax Rates

New York Car Sales Tax Calculator Ny Car Sales Tax Facts

South Dakota Taxes Sd State Income Tax Calculator Community Tax

Minnesota Sales Tax Calculator Reverse Sales Dremployee

New York Vehicle Sales Tax Fees Calculator

New York Property Tax Calculator 2020 Empire Center For Public Policy

South Dakota Taxes Sd State Income Tax Calculator Community Tax

Sales Use Tax South Dakota Department Of Revenue

New York Vehicle Sales Tax Fees Calculator